The Importance of Dividend Reinvestment Plans (DRIPs)

Disclaimer

TL;DR: Enrolling in DRIPs could dramatically increase the amount of $$ you have when you retire. Contact your broker to discuss DRIPs and the process to enroll in one. Some brokerages even allow you to enroll in DRIPs on their website.

Investing is hard enough due to the countless options available and the even more plentiful factors that influence the direction of those securities. In fact, most traders and investors will fail to beat the market.

So you have an important choice to make that has serious consequences to your retirement funds. Either bet on the market, dollar cost average, and re-evaluate when you near retirement, or try to time the market like you are more skilled than Wall Street fund managers and billionaires.

Taking your competitors into account if you do try to time the market, chances are you'll join the majority of people who lose disgusting amounts of money and vastly underperform those who simply dollar cost average an index fund. It seems like an obvious choice but lots of investors fall into the trap that forces bad decision making.

What forces smart and dumb investors alike to make bad investing decisions? News, naivety, social media, and friends. Watch the local nightly news and you tend to only hear about the markets when they are experiencing significant down moves or making new highs. News organizations then try to provide the reasoning behind the directional move in the markets. The problem is that they are grabbing at whatever makes intuitive sense at the moment, overlooking the context of a long-term timeframe.

Social media and friends are filled with biases, flawed thinking, and at times, lies. When friends are invested in a stock idea or an idea about the direction of the economy, they'll only look for information that supports their opinions--aka confirmation bias. Therefore, even a trusted friend may try to convince you about an investing idea despite having vested interest in the idea that biases their opinion.

But the biggest problem facing investors is naivety. Naivety presents itself in investors as over-confidence in their ability to pick and choose the right investments. Picking single stocks for your retirement funds will almost guarantee that you lose money over time instead of growing your funds. Why? Because investors may be able to pick a good stock, but they have no idea how to get out. The best performing stocks over the last 20 years experienced 50-90% declines (Amazon, Netflix, and Apple to name a few). Could you stomach that that massive drawdown in your retirement account without puking your shares at the bottom like the majority of investors? Probably not.

DRIPs

For the smart investors that do dollar cost average--which puts them into the top tier of successful investors right off that bat--some forget the importance of reinvesting dividends (aka DRIPs or dividend reinvestment plans). It seems like an innocuous mistake and likely a common one as well because most brokerages do not automatically enroll investors in DRIPs. Smart investors doing the right thing may be missing out on gigantic long-term returns if they failed to make this simple adjustment. But what is a DRIP?

When an index or stock pays a quarterly dividend, you have a choice to either keep the money in cash in your brokerage account or reinvest the dividend back into the index or stock by purchasing more shares of the underlying index. Most brokerages will do this for you automatically and for free if you've enrolled in the DRIP. It's that simple, however, the simple mistake of not enrolling in the DRIP--specifically index fund DRIPs--will have insanely disastrous consequences over the long-term.

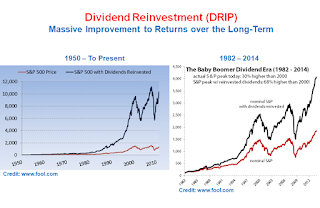

Take a look at these S&P 500 Index charts that compare an investor who didn't reinvest dividends with an investor that did:

The investor that participated in the DRIP realized a monumental return compared to the investor that didn't enroll in the DRIP. Both investors had the right idea about focusing on the long-term and avoiding timing the market--which losing investors do and vastly underperform everyone else.

Clearly, the investor that enrolled in a DRIP experienced substantially larger returns. This simple aspect of your portfolio can determine whether you retire with $500,000 or a cool $1,000,000! Both investors did the right thing and focused on the long-term, but one investor retired with significantly for funds.

Does that make sense? What do you think about DRIPs?

Jory

TL;DR: Enrolling in DRIPs could dramatically increase the amount of $$ you have when you retire. Contact your broker to discuss DRIPs and the process to enroll in one. Some brokerages even allow you to enroll in DRIPs on their website.

Investing is hard enough due to the countless options available and the even more plentiful factors that influence the direction of those securities. In fact, most traders and investors will fail to beat the market.

So you have an important choice to make that has serious consequences to your retirement funds. Either bet on the market, dollar cost average, and re-evaluate when you near retirement, or try to time the market like you are more skilled than Wall Street fund managers and billionaires.

Taking your competitors into account if you do try to time the market, chances are you'll join the majority of people who lose disgusting amounts of money and vastly underperform those who simply dollar cost average an index fund. It seems like an obvious choice but lots of investors fall into the trap that forces bad decision making.

What forces smart and dumb investors alike to make bad investing decisions? News, naivety, social media, and friends. Watch the local nightly news and you tend to only hear about the markets when they are experiencing significant down moves or making new highs. News organizations then try to provide the reasoning behind the directional move in the markets. The problem is that they are grabbing at whatever makes intuitive sense at the moment, overlooking the context of a long-term timeframe.

Social media and friends are filled with biases, flawed thinking, and at times, lies. When friends are invested in a stock idea or an idea about the direction of the economy, they'll only look for information that supports their opinions--aka confirmation bias. Therefore, even a trusted friend may try to convince you about an investing idea despite having vested interest in the idea that biases their opinion.

But the biggest problem facing investors is naivety. Naivety presents itself in investors as over-confidence in their ability to pick and choose the right investments. Picking single stocks for your retirement funds will almost guarantee that you lose money over time instead of growing your funds. Why? Because investors may be able to pick a good stock, but they have no idea how to get out. The best performing stocks over the last 20 years experienced 50-90% declines (Amazon, Netflix, and Apple to name a few). Could you stomach that that massive drawdown in your retirement account without puking your shares at the bottom like the majority of investors? Probably not.

DRIPs

For the smart investors that do dollar cost average--which puts them into the top tier of successful investors right off that bat--some forget the importance of reinvesting dividends (aka DRIPs or dividend reinvestment plans). It seems like an innocuous mistake and likely a common one as well because most brokerages do not automatically enroll investors in DRIPs. Smart investors doing the right thing may be missing out on gigantic long-term returns if they failed to make this simple adjustment. But what is a DRIP?

When an index or stock pays a quarterly dividend, you have a choice to either keep the money in cash in your brokerage account or reinvest the dividend back into the index or stock by purchasing more shares of the underlying index. Most brokerages will do this for you automatically and for free if you've enrolled in the DRIP. It's that simple, however, the simple mistake of not enrolling in the DRIP--specifically index fund DRIPs--will have insanely disastrous consequences over the long-term.

Take a look at these S&P 500 Index charts that compare an investor who didn't reinvest dividends with an investor that did:

Clearly, the investor that enrolled in a DRIP experienced substantially larger returns. This simple aspect of your portfolio can determine whether you retire with $500,000 or a cool $1,000,000! Both investors did the right thing and focused on the long-term, but one investor retired with significantly for funds.

Does that make sense? What do you think about DRIPs?

Jory

This comment has been removed by a blog administrator.

ReplyDelete